Managing Your Wealth & Planning For Retirement

Wherever you’re at in your financial journey, we provide the tools and resources necessary, and the helpful insights and guidance, to help you get there. Whatever unexpected turns in the road you’ve experienced in life, they’ve all brought you right here. So, managing your wealth and planning for retirement is about looking ahead. Learning from your life lessons and applying those lessons alongside experienced professionals who can understand where you want to go.

VISIT INVESTSENECA.COM TO LEARN HOW YOU CAN GET STARTED TODAY.

Our reasons for working in financial services are deeply personal. We repeatedly saw many friends and family struggling to find the help they needed to map out their financial future. We’re confident that with our understanding of personal finance, coupled with our training in financial services, we can help people better prepare for the future. After years in the business, we’ve developed a reputation for educating individuals in an easy-to-understand manner so they can grasp personal finance and use those concepts to pursue their financial objectives.

We believe our experience adds a broader perspective to all we do and provides increased benefits to our clients.

We can help you address:

- Investing principles and strategies

- Retirement investing and distribution strategies

- Estate conservation issues

- Risk management

We also can answer your questions, including:

- Can I retire early?

- Are my investments working hard enough?

- What’s the best approach for college savings?

- What are the elements of a sound estate strategy?

- Do I have enough life insurance for my family?

We’ve helped many individuals, families, business owners, just like you. We specialize in creating an approach that’s designed to address your individual situation. We’re with you… For Life’s Journeys.

Here are some helpful videos from “Seneca Savings University” to guide your journey.

Estate

Manage personal affairs while you’re alive and control the distribution of wealth upon your death.

Insurance

A well-structured insurance strategy can help protect your loved ones from the financial consequences of unexpected events.

Investment

Create an investment strategy that’s designed to pursue your risk tolerance, time horizon, and goals.

Lifestyle

How to strike a balance between work and leisure is just one aspect of the wide-ranging Lifestyle matters.

Money

Managing your money involves more than simply making and following a budget.

Retirement

Steps to consider so you can potentially accumulate the money you’ll need to pursue the retirement activities you want.

Tax

Understanding tax strategies can potentially help you better manage your overall tax situation.

Questions? Visit InvestSeneca.com to learn more or email LPL Financial Advisor, Greg Boshart of Financial Quest.

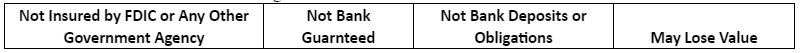

Securities and Advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker/dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. Seneca Savings and Financial Quest are not registered as a broker/dealer or investment advisor. Registered representatives of LPL offer products and services using the name Financial Quest and may also be employees of Seneca Savings. These products and services being offered through LPL or its affiliates, which are separate entities from and not affiliates of Seneca Savings or Financial Quest. Securities and insurance offered through LPL or its affiliates are: